Natural Disasters: Follow the Money

By Andrew Chanin, CEO, ProcureAM

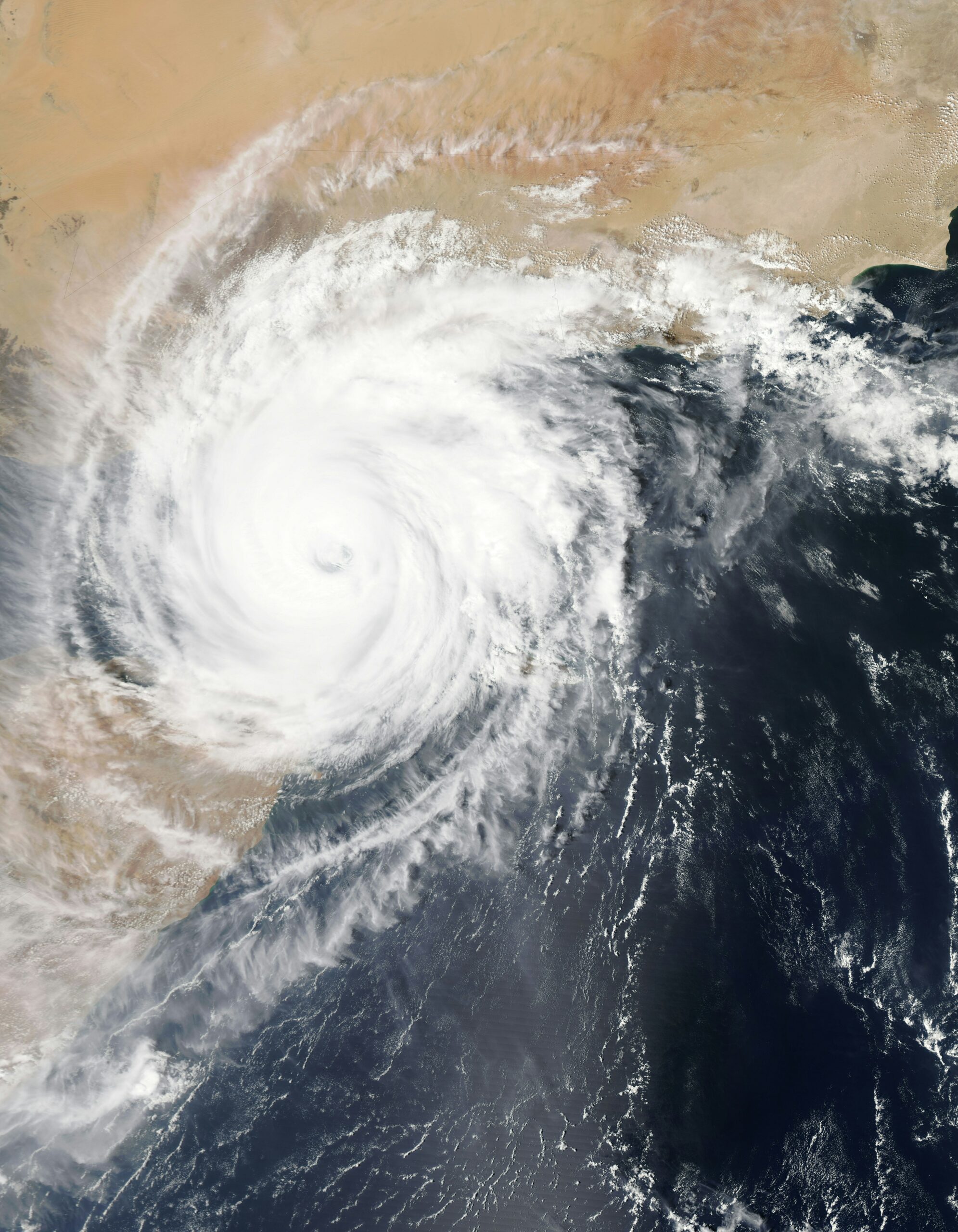

Natural disasters such as hurricanes, wildfires, and flooding are occurring more frequently and are creating more damage than in the past. According to the U.S. National Oceanic and Atmospheric Administration (NOAA), the United States has seen $37 billion in economic costs just within the first 6 months of the year.1 This extreme weather trend has increased demand for the products and services used to help in the recovery and prevention of damage caused by these disasters.

The Procure Natural Disaster Recovery Strategy ETF (NASDAQ: FIXT) consists of companies that provide short-term and long-term responses to natural disasters. It has experienced a 42.78% increase in its net asset value (NAV) since inception. Please click here for the fund’s

standardized performance.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 866-690-ETFS (3837).

There are two main options for dealing with the damage from extreme weather events:

- Clean up and repair the damage from disasters.

- Take action to mitigate future destruction.

After disasters like hurricanes, floods, and wildfires, there’s a demand for generators, pumps, clean-up management, and power restoration. Historically, communities and individuals would reach out to the Federal Emergency Management Agency (FEMA) to cover the costs of cleanup and rebuilding. However, FEMA has warned that it will run out of money by the middle of August, far before the peak of hurricane season. In some cases, FEMA has already denied requests for support.2 Insurance has been another source of recovery funds, but the rising cost of insurance and its unavailability in some places has left individuals without coverage.

If communities cannot be assured of getting help after disaster destruction has occurred, they need to be proactive and build to minimize disruptions. A recent study by Allstate Insurance found investing in resilience saves jobs and income. $1 dollar spent on resilience could save up to $13 dollars in economic savings, damages, and cleanup costs.

- Companies like AtkinsRealis* provide tools to evaluate the cost of preventative projects and the benefits they may accrue.

- Resilient utility centers, along with improved grid technology, can contain the scope of an outage. Power companies are under pressure to create better transmission systems that will not be easily impacted by natural disasters.

- Damage resistant infrastructure like highways, public buildings, and telecommunications networks are essential to bring communities and businesses back to normal after natural disasters.

The Procure Disaster Recovery Strategy ETF (FIXT) includes companies worldwide that provide products and services that are needed immediately after a natural disaster, and the companies that design and build the infrastructure to ensure resilience from extreme weather events. These firms include Fluor*, AECOM*, Oshkosh Corporation*, Generac* and Eaton Corporation*.

With more natural disasters being forecasted, it is the right time for investors to consider the FIXT ETF. For more information, visit http://www.procureetfs.com/fixt.

________________________________________

1 “Assessing the U.S. Climate in June 2024”, July 9,2024, ncei.noaa.gov.

2 “FEMA is denying requests for aid as relief fund runs dry amid record number of costly disasters”, Shruti Date Singh and Bloomberg, July 12,2024, Fortune.com.

3 “Investing in Climate Resilience Really Pays Off”, Allstate, Chamber Study Shows”, Kimberly Tallon, July 8, 2024, insurancejournal.com.

Important Information

*As of July 24th, 2024, AECOM (ACM) was a 2.32% holding, AtkinsRealis Group (ATRL CN) was a 2.24% holding, Eaton (ETN) was a 2.24% holding, Fluor Corporation (FLR) was a 2.52% holding, Generac (GNRC) was a 2.64% holding, holding, Oshkosh Corporation (OSK) was a 2.38% holding in the Procure Disaster Recovery Strategy ETF (NASDAQ: FIXT).

Please consider the Funds investment objectives, risks, and charges and expenses carefully before you invest. This and other important information is contained in the Fund’s summary prospectus and prospectus, which can be obtained by visiting procureetfs.com. Read carefully before you invest.

Investing involves risk. Principal loss is possible. The Fund is also subject to the following risks: Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Securities of small- and mid-capitalization companies may experience much more price volatility, greater spreads between their bid and ask prices and significantly lower trading volumes than securities issued by large, more established companies. The Fund is not actively managed so it would not take defensive positions in declining markets unless such positions are reflected in the underlying index. Please refer to the summary prospectus for a more detailed explanation of the Funds’ principal risks. It is not possible to invest in an index.

Natural Disaster/Epidemic Risk – Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments.

Foreign Investment Risks – Foreign securities are typically more volatile, harder to price, and less liquid than U.S. securities.

American Depositary Receipt Risk (ADR)-ADRs involve risks like those associated with investments in foreign securities, including changes in political or economic conditions of other countries and changes in the exchange rates of foreign currencies. ADRs listed on U.S. exchanges are issued by banks or trust companies and entitle the holder to all dividends and capital gains paid out on the underlying foreign shares. Investing in ADRs as a substitute for an investment directly in the foreign company shares, exposes the Fund to the risk that the ADRs may not provide a return that corresponds precisely with that of the foreign company’s shares.

The Procure Disaster Recovery Strategy ETF is neither associated with, nor endorsed by, the Federal Emergency Management Agency.

The Procure Disaster Recovery Strategy ETF is distributed by Quasar Distributors LLC.